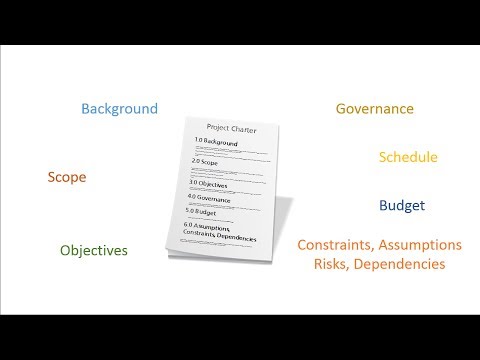

Hello and welcome to the PM Perspective video on project charters. If you've been assigned to a project and you're looking for some practical guidance, then you've come to the right place. Today, we're going to answer the following questions: What is a project charter? Why do I need a project charter? How detailed should a charter be? What information goes into a charter? And what process should you use to draft the charter? Stay tuned because we're going to show you how you can download a free project charter template at the end of this video. So let's start by explaining what exactly a project charter is. A project charter is a document of some kind. It could be a word document or something like a PowerPoint presentation. The format varies, as does the name. In a newer organization, you might have something called a project request that serves the same purpose as the charter. Or if you deal with outside clients, your scope of work may also be a stand-in for the charter. Whatever the format or regardless of what you call it, the project charter serves three basic purposes. The project charter is the document that you will use to introduce people to your project. The charter is created in the early days of your project, at a time where you may not have onboarded everyone to the project team. A project charter is a great way to get a new team member up to speed once they're assigned to your project. In addition, along the way, if there are changes to your project team as new people come into the picture, you can send them a project charter. It'll tell them everything they need to know to get started. The second reason for drafting a project...

Award-winning PDF software

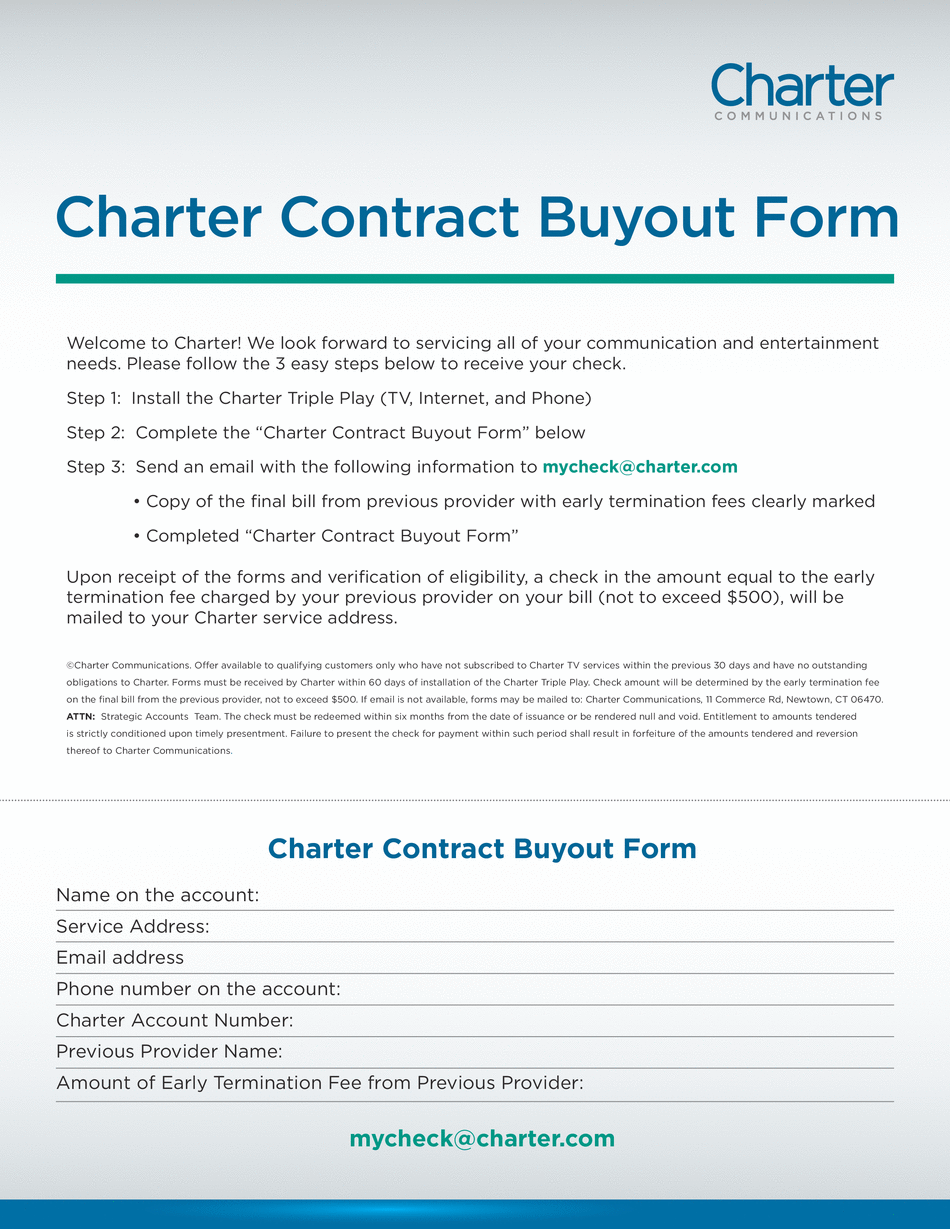

What is Charter Contract Buyout Form: What You Should Know

About form 941-X, adjusted employer's quarterly federal tax return or claim for refund On or before the due date (including extensions), file an amended or corrected Form 941-X to claim a refund for the amount shown on line 22 of the original Form 941. This does not count as a failure to file, but it must be filed even after you file your income tax return for the year of the release. After you file Form 941-X, take your time filing income tax returns. About Form 941-X Revised or Corrected After you file an amended or corrected Form 941-X, you will be given a check for the amount shown on line 22 of Form 941. The check will not include the federal tax that the IRS withheld from your wages since you may have paid taxes through payroll deduction. Pay the federal tax withheld from your wages and the IRS will refund you. About Form 941-X Revised or Corrected For the Year If you filed Form 941-X when you filed the return on which you claim a refund, you must report to the IRS the amount of the refund when you file Form 941. There are two types of returns that you can file and claim a refund for: A) A tax return on which you claimed a refund for the year; or B) A return on which you reported an income tax credit, refund (including the state and local tax portion of the credit), refundable tax credit, or earned income credit from a tax credit or refund program conducted by the Internal Revenue Service. If you have other information that should be included on your Form 941. More About Refunds · Forms, publications, and other information. Form 941-X — Prior Year Products Form 941-XAdjusted Employer's Quarterly Federal Tax Return or Claim for Refund2022Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund2021Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund2020Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund2019Form 941-X Jan 1, 2024 — To tell the IRS that Form 941 for a particular quarter is your final return, check the box on line 15 and enter the date you last paid wages.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Charter Contract Buyout , steer clear of blunders along with furnish it in a timely manner:

How to complete any Charter Contract Buyout online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Charter Contract Buyout by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Charter Contract Buyout from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is Charter Contract Buyout